The need for climate adaptation will soon spur the emergence of a range of new products and services. This creates a business case where investors might expect both a market-rate return and positive climate adaptation impact from their investment, if only we apply the right lens.

What is changing following climate change?

Even if we don’t discuss melting glaciers, rising sea levels, or warming oceans, and instead focus solely on the immediate consequences, we can still observe that the entire status quo is changing. Year by year, we encounter more instances of extreme weather conditions, droughts, fires, shortages of fresh water supplies and hydropower, and stress on the energy grid.

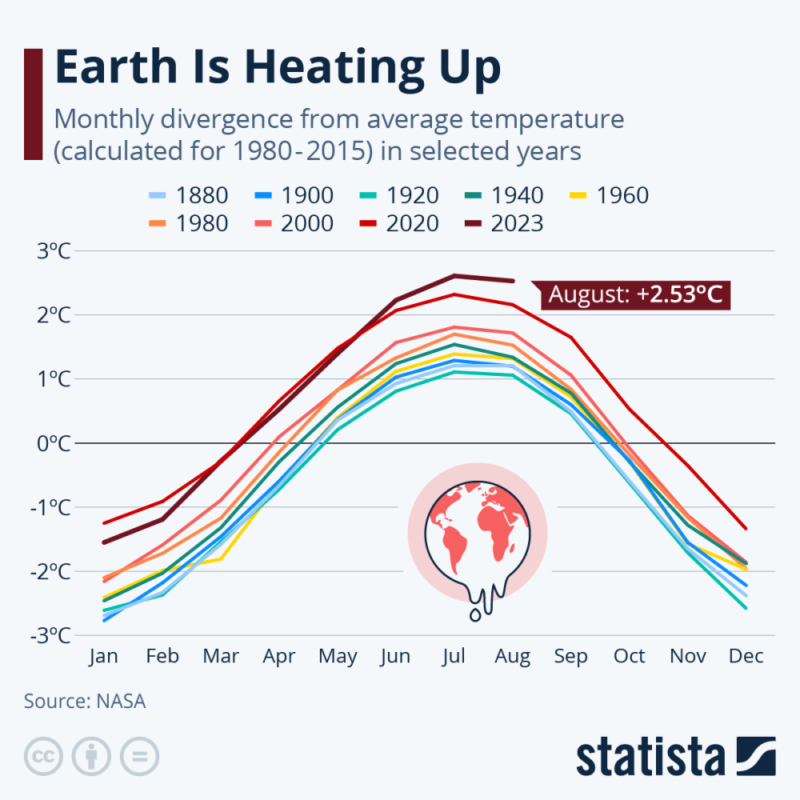

Let’s not focus on everything and just take one example. Here it is – the planet is getting hotter.

https://www.statista.com/chart/19048/global-warming-monthly-divergence/

Remember extreme heat waves last summer all over Europe and even recently? In Paris specialists recorded a temperature of 56℃ bouncing off the concrete outside the Garnier Opera House.

Just one example among many, but there is a wealth of other scientific evidence too: from surpassing world temperature records worldwide and documented increases in heat-related deaths, to melting glaciers and alterations in the migration patterns of birds and fish.

What’s in it for PE funds?

Multiple startups and enterprises emerge every year to fight climate change. But as investors, what criteria are we seeking when searching for investment opportunities?

First of all, we are looking in the ‘very usual’ directions: renewable energy, power stations, reducing and offsetting carbon emissions.

Secondly, when speaking about investment in climate adaptation, we usually refer to governmental aid with great social impact in the developing world.

This approach limits our chances to find opportunities that lie off the beaten path.

What if we adopt a different perspective?

First, let’s examine whether there are any opportunities in the present state of the world.

Second, let’s steer clear of asset-heavy businesses for now and instead focus on asset-light ventures.

Third, let’s delve into the trend that is right in front of us.

15 years ago we witnessed a trend for “100% green/ organic/ eco” products. These labels almost simultaneously appear on so many goods that it couldn’t have been an accident. Those who invested early on in it were pretty satisfied with their IRRs.

I believe that now we have another trend at our doorstep: “heat-resistant” or “heat-protective” goods.

The private equity investment model typically supports asset light businesses. Software businesses or healthcare had been darlings of the industry. So, if we apply the same approach but look at it from a ‘climate’ perspective, we might discover that a good long-term investment will be the one into innovative production of anything heat-resistant or heat-protective or heat-preventing.

Brief search comes up with a range of products reflecting this trend:

- Companies specialising in production of cool roofs, green roofs and vertical gardens

- Producers of heat-resistance materials for hospitals and houses

- Production of medication for heat stress relief

- Development of software tools like The Extreme Heat Vulnerability mapping tool or Thermal Comfort Tool

- Companies using scientific approaches to design innovative, sustainable materials for sport, packaging and apparel industries

And we will be seeing more of them. This is a rising opportunity with a well-balanced impact/IRRs effect across the globe.

Try not to miss out.

The article was originally published on Private Equity for Climate LinkedIn page on May 6, 2024