Over the past 35 years, significant progress has been made in understanding climate change. With the higher degree of certainty, within AR6 IPCC report, scientists confirmed the unequivocal anthropogenic nature of global warming is due the emission of various greenhouse gases in the atmosphere. In the latest impact report WG2 , researchers with high degree of certainty attributed a number of detrimental effects on the planet’s health to climate change.

In the context of Private Equity investing, climate change can be not only existential threat, but present an important investment opportunity in the coming decades, as we dive into below.

Why the 2020-2030 is the critical decade for climate investing?

Scientists refer to the concept of carbon budget, or the aggregated GHG emissions we can still ’afford’ before the planet will reach the global average temperature of 16 degrees. This level of temperature would activate a number of negative cascading effects of disastrous and chronic weather changes, to which we all will have to adapt. The carbon budget, according to IPCC AR6, is ranging between 400 GT and 1,150 GT of CO2 emissions to keep the global warming within 1.5 degrees and 2 degrees respectively with 67% probability. This means we could be reaching 1.5 degrees warming by 2030, and 2 degrees by 2048, provided the GHG emissions remain at the 2019 levels.

To increase the likelihood of maintaining global warming within 1.5 degrees, we need to adapt our current systems and processes concerning energy, food and housing. A system wide transformation takes a long time, so it is critical to start now. Also, the emissions of the greenhouse in the atmosphere are cumulative, and as we keep emitting more, we bring ourselves into a deadlock of needing to reduce more in the future.

There have been various ‘calls for action’ to front-load the emission reductions, so that we can get some cushion and adapt to future changes. Also, the researchers are concerned that the technological solutions that are being developed today won’t be a ‘magic pill’ that would help remove the bulk of emissions in the future.

All eyes are on the government policies to support for the so-called ‘Just transition’ to the new global economy. But then next to the government, private and public investing can play a significant role.

Private Equity has long been recognized globally as means to preserve the capital and wealth for the future generations. Considering the long-term climate impact on future generations, we believe that the private equity approach and tools are well-suited to assist the planet in the Just transition. Institutional investors allocating to private equity usually evaluate the strength and expected longevity of the private equity franchise. To ensure the latter, the private equity firms must adapt to the climate change and find their place in the new economy.

Why do institutional investors need to act now?

Private equity is a long-term business, and its effects on the economy are best seen over time. For institutional investors wanting to understand how their funds contribute to climate efforts, we recommend setting realistic timelines for developing a strategy.

Here is an example time frame for establishing a climate investing program:

- Setting up a climate investing program might take 1-2 years;

- The average fund cycle lasts 10-12 years, and only at the end of it we can fully evaluate the impact of the fund investments on climate;

- Often, lessons learned from the first fund generation need to be incorporated into the next funding cycle, which typically occurs every 3-4 years. Taking this into account, we have a span of 14-18 years;

- To claim that we have a fully operational program and comprehend our climate impact would require 2-3 fund cycles. Factoring in an additional 3-4 years, this extends to 17-22 years.

Let’s sum it up. If an institutional investor starts running their climate fund of funds in 2024, they can fully recognize the impact and the effects of their funds on climate mitigation by 2041-2046.

This simulation assumes that institutional investors will find a way to assess the sustained long-term effect in climate mitigation and adaptation given the product/services life cycle is longer than the average portfolio company holding period.

What investment framework do we suggest at PEC?

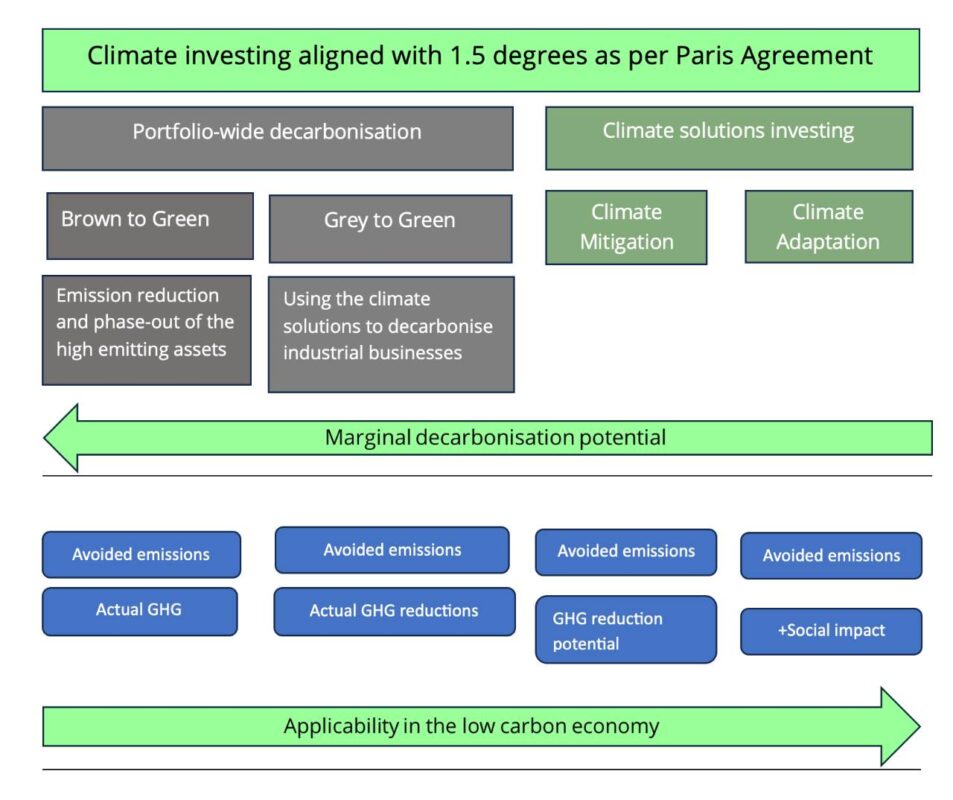

Recognizing the need to reduce emissions early and transition to a low-carbon economy, we’ve developed a climate solutions investment opportunity. In our framework, known as the PEC-way, we prioritize investments that align with the 1.5 degrees warming target of the Paris Agreement, even as formal guidelines are still forthcoming.

To do so, we have reviewed the financial sector and private equity guidelines, namely:

- We took the Private Markets Decarbonisation roadmap for the definition of Climate solutions. There, the climate solutions are defined in line with GFANZ guidance below.

- We reviewed the Recommendations and Guidance on Financial institutions Net zero transition provided by GFANZ. They refer to ’climate solutions’ as solutions that support mitigation of climate change and emissions reduction. GFANZ acknowledges that a broader use of the term may include solutions that are aimed at developing adaptation. We believe the climate solutions helping the world to adapt to the warmer planet are as important as the climate mitigation solutions.

- In the Net Zero investment Framework, component for the Private Equity , the IIGCC say that they are yet to define the climate solutions investing framework for private markets.

The above frameworks are valuable to investors in their decarbonisation journey. When institutional investors consider the impact of their decarbonisation efforts, they focus on the GHG emissions reductions. Albeit as we progress towards net zero emissions, the forthcoming impact of emissions reductions will be marginal in the next decade(s).

In our framework, we have added a new dimension – the applicability of the solutions in the low-carbon economy.

Intuitively, this is the indicator of how things will be in the low-carbon economy, where the role of fossil fuels is minimal, and the industry has changed its way of operations towards renewable energy and materials.

We have placed a scale ’High’ to Climate Adaptation solutions, and ’Low’ to the fossil fuel companies and general industry. This scale helps us to see that companies that spearheaded and facilitated this shift to eco-friendly fuels and materials will emerge as influential players in the future.

Where to go from here?

This brings us to the current state of institutional investors’ portfolio allocations to climate solutions.

Investors have pledged their capital to net zero, albeit there is no comprehensive data on the effective allocation of institutional capital to climate solutions across the private equity investment strategies. From the limited information available, it appears that portfolio allocations typically hover around 10%, while most of the capital is allocated to decarbonisation efforts.

Similar to the experience of countries transitioning to a low-carbon economy, the institutional investors and private equity managers should consider the importance of being ahead of the curve. We observe similar dynamics, as being low carbon creates competitive advantage for the countries, it might create competitive advantage for the investors. By safeguarding and advancing their portfolios towards the low-carbon economy they can also benefit from a ‘first mover’ advantage.